Greece’s Biggest Lenders

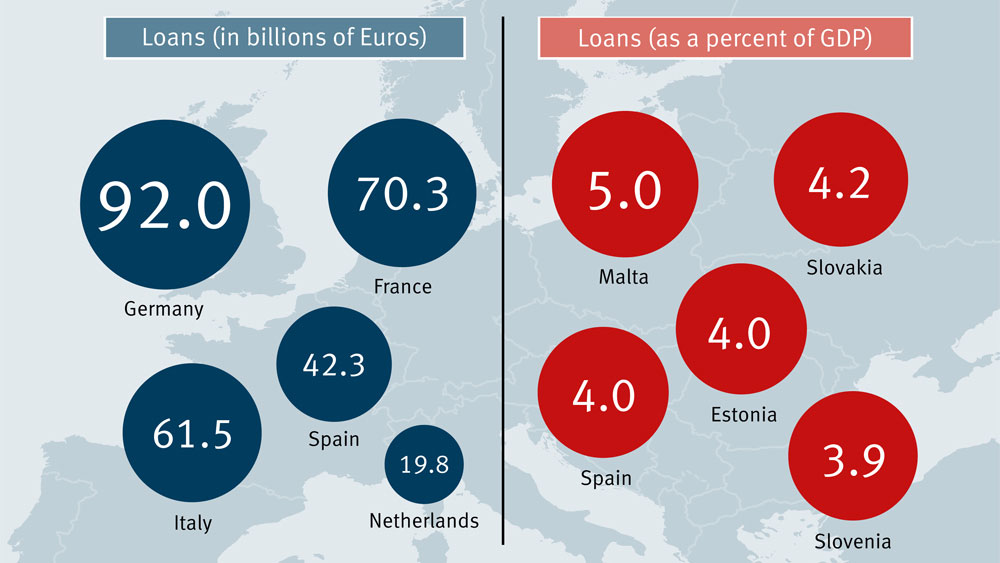

The notion of “European solidarity” cuts many ways; right now, it needs to be applied to the EU’s two most pressing problems, Greece and refugees. At the moment, the numbers are a bit lopsided.The stand-off over Greece’s debt and impeding bankruptcy – which seems to be part of a never-ending story – is tricky in part because of how many parties are owed: a bailout in 2010 and another in 2012, coupled with a restructuring the same year, have rendered it nearly impossible to predict what the impact of a complete default might be. According to Bloomberg and the Financial Times, eurozone governments own 62 percent of the Greek government’s loans and bonds, the private sector 17 percent, the IMF 10 percent, and the European Central Bank (ECB) 8 percent. The Central Bank of Greece owns the remaining three percent. Within the eurozone, the countries that have loaned the most are, according to a study by Barclays Research from April 2015, Germany (92 billion euros), France (70.3 billion euros), Italy (61.5 billion euros), Spain (42.3 billion euros), and the Netherlands (19.9 billion euros).

…

Read the complete article in the Berlin Policy Journal App – July/August 2015 issue.