Slowing growth in China carries repercussions, not least for the country itself. Four scenarios could result from responses Beijing might adopt; the West should be prepared for all of them.

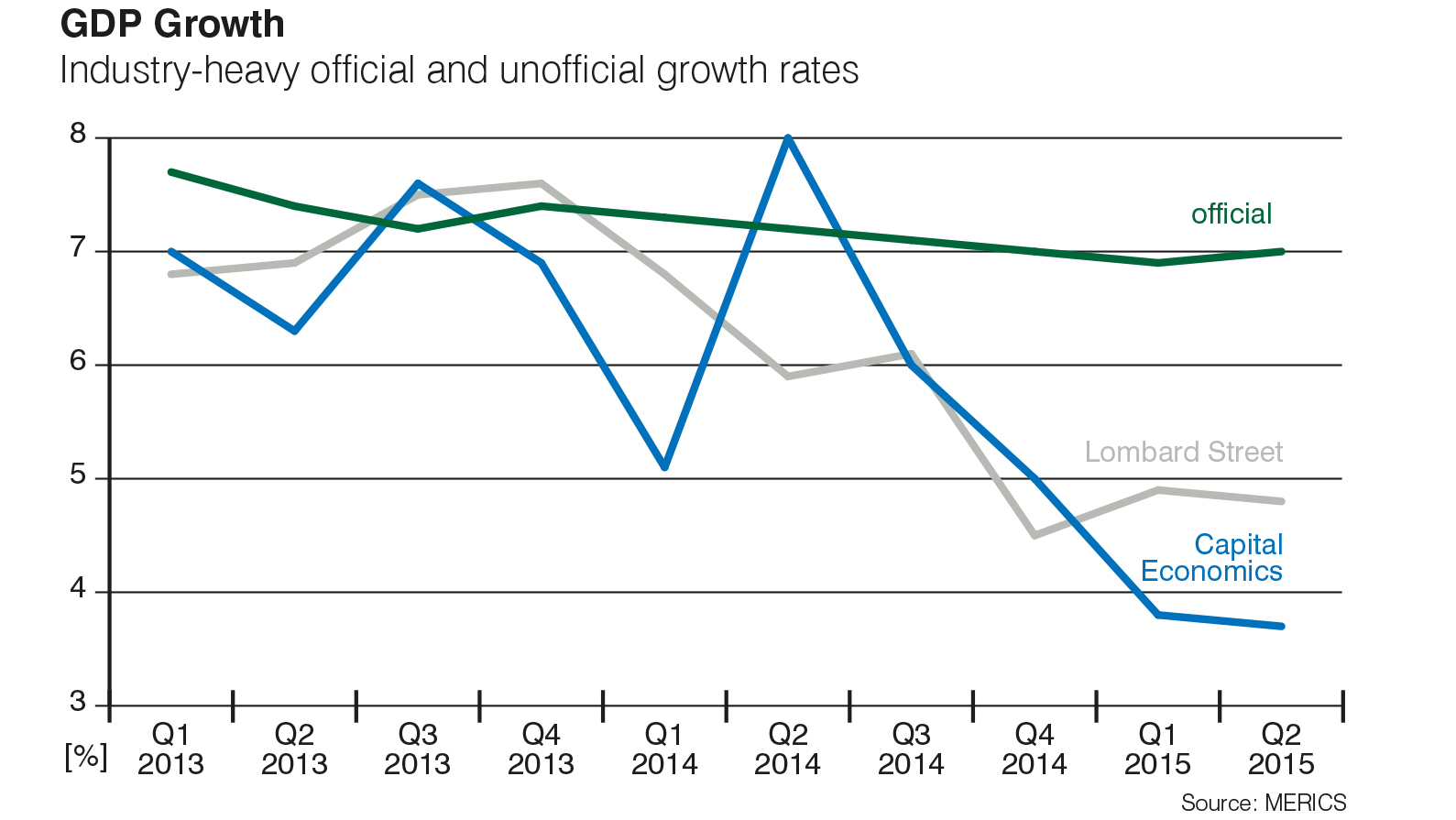

The Chinese economy is facing significant downward pressure. This gradual slowdown after decades of economic growth should not come as a surprise – it actually follows a pattern we have seen in other high-growth economies in East Asia in the past that transition to a qualitatively new growth model, one driven by consumption, services, innovation, and productivity rather than investment and exports. The current downturn is not a question of temporary economic weakness with cyclically delayed recovery; it is a crisis of structural adjustment, one affecting many sectors of the economy that have driven Chinese growth in the past.As a result, uncertainty is increasing regarding China’s contribution to global demand and growth. Chinese output, investment, exports, and prices are not in free fall so far, and market volatility and government interventions in China’s stock markets are no indicator of the overall state of the real economy. However, signs of an impending crisis are growing in many sectors of the real economy, most obviously in construction, heavy industry, and commodities. The drop in producer prices in industry reveals deflationary tendencies. It is a result of both decreasing input (commodities) prices and vast industrial over-capacities in many branches of China’s industry. In micro-economic terms, industrial crisis manifests itself as worsening payment practices on the part of Chinese companies and as cuts in production in the construction industry and shipbuilding, albeit thus far without massive waves of redundancies.

A number of positive trends complicate any simple doom and gloom predictions: Strong forces of growth are at work in the service and health industries, as well as in web business and consumer demand. Thanks to new financing opportunities and relaxed regulations, many urban and – surprisingly – rural areas have seen a real boom in the creation of SMEs (though with uncertain consequences for actual growth and employment). There have also recently been signs of recovery in property prices in many large cities.

In the short and medium term, however, these new sources of growth will not be capable of compensating for pronounced weaknesses in traditional sectors that have driven growth over the last two decades, now putting immense pressure on the government’s economic policies.

Moreover, the government’s policy response has been unusually hesitant and inconsistent. Contradicting signals and interventions from financial market regulators and the central bank have unsettled investors and consumers alike. Popular trust in Chinese leadership’s economic competence, capacity for action, and drive for reform has taken a severe knock. And the stability of the financial and fiscal system has been called into question as a result of the rapidly growing debt burden carried by local governments and state-run private businesses: the central government’s ability to pay off these debts is in a much worse state than incomplete official budgetary figures would suggest.

The most important questions in the medium term, however, concern the resolve and ability of Chinese leaders under Xi Jinping and Li Keqiang (the “Xi-Li administration”) to actually implement the comprehensive program of economic restructuring and liberalization that the Communist Party’s Central Committee announced in 2013. The impetus for reform currently seems unpredictable. Further steps in crucial areas due for reform, such as state enterprises or central-local fiscal relations, have not made substantial headway yet. The economic events of 2015 have made one thing clear: compared to previous economic downturns, the Chinese government is now much less effective in steering business, investor, and consumer behavior through direct interventions.

If China’s growth keeps dropping, and reforms fail to materialize, the slowdown in the country might have long-lasting negative effects on a global economy already under pressure.

The “New Normal”

The Xi-Li administration’s predicted development scenario for China’s switch to a new growth model has been dubbed the “new normal”: growth will fall slowly over several years, eventually reaching a plateau at a lower, yet more sustainable and resource-saving level with the help of politically controlled, state-supported, socially viable steps.

The current accelerated downward trend was not part of the plan: a slump of this kind can result in an increased risk of social and political destabilization. However, the experiences of economies that have undergone fundamental structural change in the past (particularly former state economies) is instructive for the Chinese case: China may have to go through a so-called “J” curve, a temporary drop in economic output followed by another dynamic phase spurred by new growth drivers.

This temporary drop in growth associated with structural reform is difficult to sell politically in any kind of regime – the ruling government generally takes the blame and faces a loss of public support. In democratic systems, the government that initiated the policy shift is often voted out; former SPD chancellor Gerhard Schröder’s government and its reformist “Agenda 2010” may be seen as a textbook example of this phenomenon.

For China’s political leadership, however, the political risks of a “J” curve are understandably unacceptable: the Chinese Communist Party cannot possibly tolerate the risks of social and political destabilization that are associated with a curve of this kind. As the CCP cannot be voted out, such a scenario would put the entire political system as it stands in danger.

As a result, it is highly likely that the Chinese government will resort to new stimulus programs should the current downward economic trend become too negative rather than risking social destabilization and the resulting loss of political support and power.

Best-Case Scenario: the Spoon Curve

The dynamics and consequences associated with the J curve are politically worrisome. But China’s economy has the potential to overcome the trough and subsequent rise in growth more quickly than most transition economies we have seen in the past – thanks to continuing growth dynamics in the consumer, service, and health sectors along with private and internet-based industries, the country may just go through a mild variation of a structural adjustment crisis known as a spoon curve. However, to ensure this growth pattern, China’s government will have to press ahead with deregulation for private and foreign investors in sectors that have been characterized in the past by protectionism, or have been state monopolies and oligopolies until now.

A spoon curve of this kind would involve a temporary, moderate drop in growth, followed by a slight rise that would level out into a plateau, one that represents much more modest growth than China has experienced in the past, but which should also be more sustainable. This currently appears to be the best possible scenario for China’s transition to a new growth model. This paradigm, however, implies a fundamental transfer of assets, financial resources, and decision-making powers away from governmental bodies to private firms, investors, and households. As such a drastic strengthening of the private sector at the expense of state control is unlikely to be politically acceptable to the current administration, a spoon curve is not very likely to be the course the government will actively support.

The pressure on China’s government to allow drastic deregulation, liberalization, and privatization of the economy, despite current political and ideological resistance, could increase if downward trends in the economy accelerate.

The Most Dangerous Scenario

The most dangerous economic and political scenario would be for growth to plunge in 2016-17 without substantial new growth forces appearing to cushion a hard landing. This type of rapid, negative development within a short time would present a high risk of political and economic disruption across China. A hard landing of this type would, in all likelihood, be associated with a loss of unity and capacity to act on the part of the political leadership.

This worst-case scenario cannot be ruled out if external shocks (like a global financial crisis accompanied by a global downturn in demand) start to affect the Chinese economy. As a result of the current weak state of the global economy and its current lack of growth engines, a hard landing in China would have fatal knock-on effects globally.

Looking at the current situation, the likelihood of this worst-case scenario coming to pass is actually quite low – a catastrophe of this kind would only occur if destabilizing domestic and global economic events combined with severe internal and/or international political tensions.

Most Likely: Deferred Change

Due to economic and political restrictions, neither the “new normal” nor the spoon curve appear achievable at the moment. This leads to an alternative possibility, one that has already been realized in the largest economies since the onset of the global financial and economic crisis in 2007. This approach to economic policy takes the form of government- and central bank-sponsored stimulus and stabilization packages. It utilizes different variants of “quantitative easing” with the aim of deferring inevitable but risky re-regulation and restructuring in the economy, which would carry uncomfortable political consequences. At its core, this approach aims to avoid political trouble, instead buying time for structural adjustments to be made later under more favorable macroeconomic conditions.

In China, this pattern of deferred adjustment took the form of a huge stimulus package amounting to 14 percent of the country’s total GDP between 2008 and 2011. The consequences were a flood of loans and investments not reviewed for viability, and the creation of huge levels of excess capacity in industry and physical infrastructure. As a result, China has to face a quickly growing debt burden, the formation of investment bubbles, excess industrial capacity, a slump in producer prices with a tendency toward deflation, and the likelihood of medium- to long-term stagnation. China’s long-lasting, extremely high levels of investment generate less and less growth. State-controlled investment tends to concentrate on established industries and the state sector, with only a limited percentage going to future growth industries and the private sector.

Starting from a political calculus, renewed stimulus packages remain attractive, as any steps toward the inevitable changes ahead can be deferred. Consequently, this approach seems to be the most likely as things stand in the Xi-Li administration’s economic policy once it becomes clear that the controlled structural change referred to as the “new normal” cannot be implemented successfully – and thus the political and social risks involved in this type of economic development threaten to spiral out of control.

This process – stimulus, debt, excess capacity, deflation, and finally stagnation – displays similarities with Japan’s macro-economic experiences since the early 1990s. Unlike in Japan, however, medium- and long-term stagnation in China is likely to be associated with a much larger risk of social and political destabilization. The extremely ambitious Chinese population is characterized by having disparately high expectations with regard to its economic future: promised growth is an essential part of the tacit agreement between the CCP and China’s middle and upper classes. The deferral of structural reform and the advent of stagnation, therefore, would severely aggravate social and political tensions, and likely result in systemic disruption.

Repercussions on Economic Interactions

China’s function as a global growth engine is under question, and a long-lasting or abrupt drop in demand from China would have far-reaching consequences for the global economy.

The slump in Chinese demand is already having highly negative consequences on global commodity prices and on the country’s suppliers, from Brazil, Australia, and Indonesia to Angola, Nigeria, and South Africa. Moreover, trade relationships with leading global export economies such as Germany, Japan, and South Korea have seen unusual downward pressure in 2015 in previously very sound sectors.

Foreign currency and financial markets are also being affected by the slowdown in Chinese growth. Weakening Chinese demand for commodities, in particular, aggravates the negative impact on emerging markets of an expected interest rate rise from the United States. Both factors work to increase capital drain, currency depreciation, and debt servicing pressures in emerging markets.

A slump in China will likely result in a reorientation of international funding initiatives launched by the Chinese government, too. The profitability of foreign investments made by state banks or state enterprises and the government’s capital injections in the framework of the Asian Infrastructure Investment Bank (AIIB) or the Silk Road initiative will become urgent and contested issues within China. Many of the recent large-scale outbound funding initiatives will be subject to much stricter scrutiny in the context of an internal economic downturn.

In any event, support and financing for domestic structural adjustments in China will be given priority over investment and involvement in high-risk countries such as Pakistan, Venezuela, and Zimbabwe. Should China’s domestic economy experience a hard landing, a reduction or reversal of costly geopolitical ambitions, especially the Silk Road initiative, will appear on the political agenda.

At the same time, current negotiations between the Chinese government and the US and the EU regarding enhanced investment and trade agreements can be positively accelerated in the context of a demand crisis in the Chinese and global economy. All trading nations will have to become more resolute in breaking down investment and trade barriers so as to counteract a contraction in world trade and global growth.